NEWS RELEASE

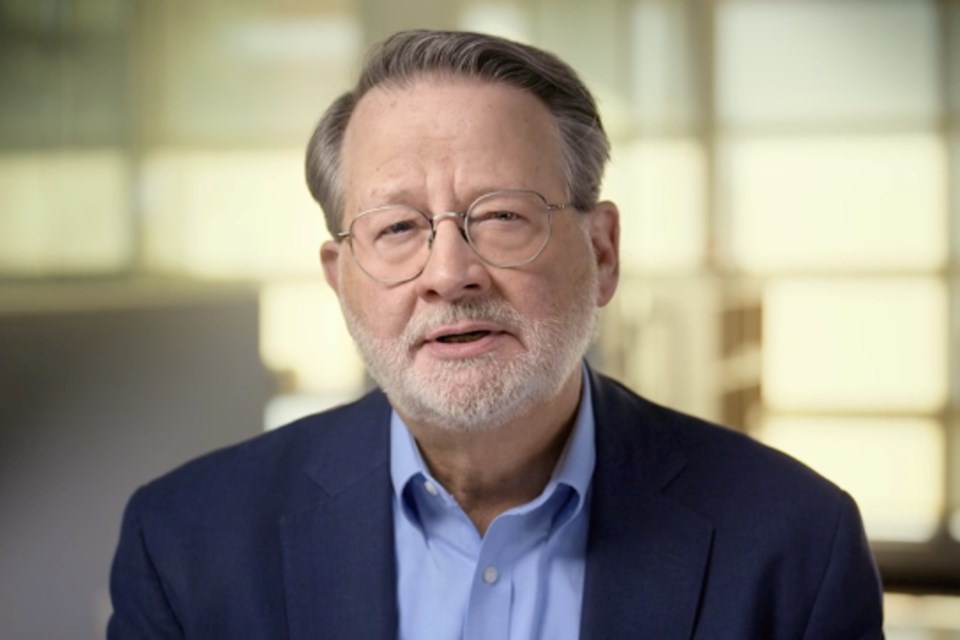

U.S. SENATOR GARY PETERS

************************

U.S. Senator Gary Peters (MI) joined his colleagues in calling for the Trump Administration to immediately reverse its decision to shutter the Consumer Financial Protection Bureau (CFPB). The CFPB provides relief to Americans who have been wronged by unethical practices from banks, payday lenders, and other financial companies by investigating and addressing consumer complaints about financial products and services. For example, the CFPB put in place rules that prevent mortgage lenders from issuing loans with hidden terms and costs that have caused people to lose their homes. The CFPB has also taken action against unreasonable bank overdraft fees which has encouraged other banks to remove or reduce their overdraft policies to avoid being penalized. Since the agency’s creation, the CFPB has returned over $21 billion owed to American consumers who have fallen victim to abusive and illegal activity from financial institutions.

In a letter led by Peters and his colleagues, the senators underscored how the Administration’s decision to close the CFPB and idle its nearly 2,000 employees will make Americans more susceptible to predatory lending and other deceitful financial practices, particularly servicemembers and military families who are at heightened risk of being targeted by these tactics. This is because the Administration’s decision also halted key CFPB oversight of protections from the Military Lending Act (MLA) and Servicemembers Civil Relief Act (SCRA) that prevent servicemembers from being taken advantage of. These protections support our military readiness, recruitment, and retention efforts by allowing servicemembers to focus on their service obligations while on active duty, rather than worrying about making ends meet at home. Peters and his colleagues urged the CFPB to resume its essential work of investigating violations of consumer financial protection laws and taking actions against scammers and payday lenders to protect the financial well-being of our military families and all Americans.

“This funding, supervision, enforcement, and communications freeze will hit military families especially hard. Without a functional CFPB, military families will be stripped of their financial protections under the bipartisan Military Lending Act (MLA) that they have earned and deserve by serving our Nation,” Peters and the senators wrote. “The CFPB is the primary agency responsible for supervising and enforcing the MLA against nonbank financial companies, including payday lenders, pawnshops, and debt collectors who have charged servicemembers interest rates as high as 600% and who have threatened to derail their careers if they do not pay up.”

“Accordingly, we request that the CFPB continue to supervise and investigate violations of the consumer financial protection laws and take forceful enforcement actions against lenders that violate the law, especially when it comes to predatory lending that harms our military readiness. We also request that the CFPB continue to make public communications to consumers, especially to servicemembers regarding the rights that they are owed under the SCRA,” the letter concluded.

To read the full text of the letter, click here.

************************